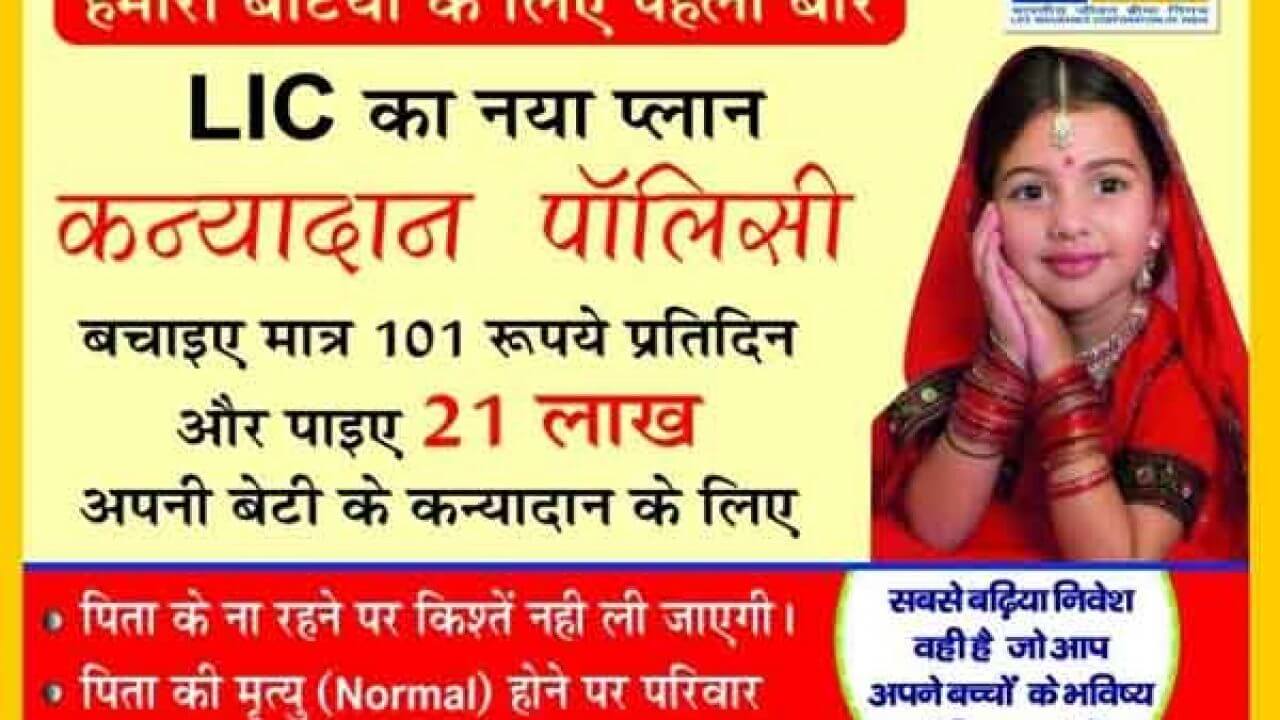

LIC Jeevan Goal Plan | LIC Kanyadan Policy | LIC Kanyadan Bima | LIC Kanyadan Bima | LIC Jeevan Lakshya Yojana (833) | lic Kanyadan Policy | Leach Kanyadan Policy Details | Leach Kanyadan Policy Premium Chart

Friends, today we are going to tell you about LIC Jeevan Lakshya Yojana / lic kanyadan policy details 2020 in hindi / lic kanyadan policy 2020. We also call this scheme LIC Kanyadan Policy, what are the benefits of this scheme? All will elaborate on that if you take the LIC life goals scheme, what are the benefits to you? And how much insurance will you be given? We will tell you in full detail about it.

lic kanyadan policy detail in hindi / lich kanyadan policy details The death benefit to the policy holder is given in an annual installment during the Hindi scheme, which caters to the financial needs of his family after the death of the policy holder. In addition to the annual payment in case of death of the policy holder, an additional 110% cover amount is paid to the nominee at the end of the policy term. In this plan you also get the benefit of bonus declared by LIC every year.

Table of Contents

LIC Kanyadaan Policy | LIC Kanyadan Policy – The Perfect Gift For Your Beloved Daughter

Age of entry – 18- 50 years

Policy term – 13 – 25 years

Premium Payment Term – (Plan Term – 3) years

Sum Assured 100000 – Unlimited (in multiples of 10000)

Premium Payment Mode – Monthly (SSS, NACH), Quarterly, Half Yearly, Annual

Premium payment mode – discount 2% yearly, 1% on half yearly, 0% quarterly and monthly

High Sum Assured Discount 0% Sum Assured – (0 – 2,00,000) 2% Sum Assured – (2,00,000 – 4,90,000)

3% Sum Assured – (5,00,000 and above)

Read Also – Pradhan Mantri Mudra Yojana

Benefits of LIC grant policy

- If the death occurs during the policy term, 10% of the basic sum assured will be paid to the nominee every year from the year of death till the date of maturity.

- At the end of the policy term, the maturity nominee will be given the Sum Assured (110% of the Sum Assured) + Simple Reversionary Bonus + Final Additional Bonus (if any) on death.

- If the policy holder has paid all the appropriate premiums by the end of the policy term then the policy holder has to

- Maturity amount = Sum Assured + Vested Simple Revision Bonus + Final Additional Bonus (if any), will be given

- Where the Sum Assured at maturity is equal to the Basic Sum Assured.

At what age will you get this policy

For taking this policy, minimum age should be 30 years and daughter’s age is 1 year. This plan will be available for 25, but the premium will have to be paid for 22 years only. But this policy is also available according to the different ages of you and your daughter. This will reduce the time limit of this policy according to the daughter’s age.

How does LIC Kanyadaan policy work?

When purchasing a policy, the policy holder chooses the cover amount (Sum Assured) and the term of the policy. You have to pay the premium for three years less than the policy term (policy term – 3 years).

- If the policy holder survives the entire policy term, on maturity, the policy holder gets back the sum assured and the accumulated bonus.

- If the policy holder dies during the policy term, 10% of the sum assured is paid as an annual installment to the nominee as a death benefit.

- Also, 110% of the Sum Assured (along with Reversionary Bonus and Final Edition Bonus) is paid to the nominee at the end of the policy term.

Read Also – Uttar Pradesh Labor Department registration online

Documents for LIC Jeevan Goal Plan

LIC’s new insurance savings plan requires you to submit the following documents.

- Duly filled and signed form of the proposal for the scheme

- Check or cash to pay the first premium

- Passport size photograph

- Valid identity card

- address proof

- Date of birth proof

- Proof of income

In case of accidental death, an additional sum equal to the sum assured is payable to the nominee, the calculation is shown as the Accidental Life Assurance. Calculating the death benefit by year and age, indicating the accumulated bonus and the final enhancement bonus. Given below.

Income tax benefit in LIC Kanyadaan policy

Payment of premium: The premium to be paid under this scheme is exempted under Section 80C of Income Tax. At most, you get Rs. 1.5 lakh can be discounted.

Maturity and Death Claim: The amount of maturity or death benefit received under this scheme is exempt under Section 10 (10D) of Income Tax. There is no limit on the amount of benefit under this scheme.

A look at the policy

Take a policy for 25 years.

- Premium has to be paid for 22 years.

- Rose 121 rupees or about 3600 rupees a month.

- If the insured dies, the family will not have to pay any premium.

- Betty will get 1 lakh rupees every year during the remaining year of the policy.

Read Also – Punjab Fard Jamabandi online

On completion of the policy, the nominee will get 27 lakh rupees.

This policy can also be taken for less or more premium.